What is contract planning and management?

High level planning for the management of contracts commences in the procurement planning phase. It is a continuum of the procurement process and derives from the contract management planning strategy, complexity assessment, market analysis and review, market approach and continues right through contract negotiation, implementation and outcomes evaluation.

Contract planning and management covers all activities at the commencement of, during and after the contract period. It is the process that ensures both parties to a contract fully meet their respective obligations as effectively and efficiently as possible, in order to continually deliver both the business and operational objectives required from the contract.

Why is contract planning and management important?

Contract planning ensures delivery of desired procurement outcomes. It may consider a broad range of factors including:

- driving continuous improvement

- value preservation and additional value creation

- performance management

- risk mitigation, role clarity, and the value of supplier relationship

- quality assurance

Contract planning differs from contract management which ensures that a contract delivers what has been specified, within defined timelines, in accordance with stated performance standards, without defect and delivered at the agreed price/costs.

Contract planning and management in the procurement process

The contract planning and management process is dictated by the complexity of the individual procurement, its criticality to the organisations core operations and associated risk profile. The level of applicability and frequency of the factors discussed in this guide are scalable based on the nature of the procurement. At the strategic end of the complexity scale the relevance of contract planning is more significant compared to the transactional end of the procurement complexity scale.

Aligning the assessment of complexity with contract planning and management

Contract planning and contract management build on the process steps that lead to the creation of a contract and the delivery of an outcome to the contracting body.

The ability to leverage off the contract management planning strategy and complexity analysis facilitates targeting of advice to procurement practitioners in the form of tools and templates, that is task relevant, clear and scalable as required.

The assessment of complexity has been used as a key determinant in defining the scope of issues and considerations that need to be taken into account at various stages of the procurement process.

There is a relationship between the assessment of complexity and the identified contract planning and management segments.

To simplify the complexity to contract planning and contract management alignment, procurement assessed as strategic aligns directly to the strategic segment. Similarly, complexity of a transactional nature aligns directly to the operational segment.

The critical decision for procurement practitioners is then only to determine whether complexity of a leveraged or focused nature is of high or low risk, as this impacts on the scope of tasks that apply in contract planning and contract management.

The following tools are available to assist:

- contract risk segmentation tool - to identify individual risks at the procurement activity level for each contract and to assist in differentiating high risk from low risk contracts

- defining criticality to business assessment tool - to calculate the significance or degree to which the contract is critical to business of the organisation

Where the contract risk segmentation tool risk rating is above five, the contract management segment would be ‘high risk’ or ‘strategic’. If less than five it will be ‘transactional’ or ‘critical to business’.

Where the defining criticality to business assessment tool rating is above five, it will fall under the ‘strategic’ or ‘critical to business’ segments. If less than five it will be within the ‘transactional’ or ‘high risk’ segments.

The two ratings’ score will determine the final contract management segments. For example, a risk rating of six and a criticality rating three, would indicate that the contract management segment will be ‘high risk’.

Although the tools have applicability to procurement assessed as being of leveraged and focused complexity, they can also be used to monitor risks over the life of a long-term contract (three+ years) and contracts of a strategic nature.

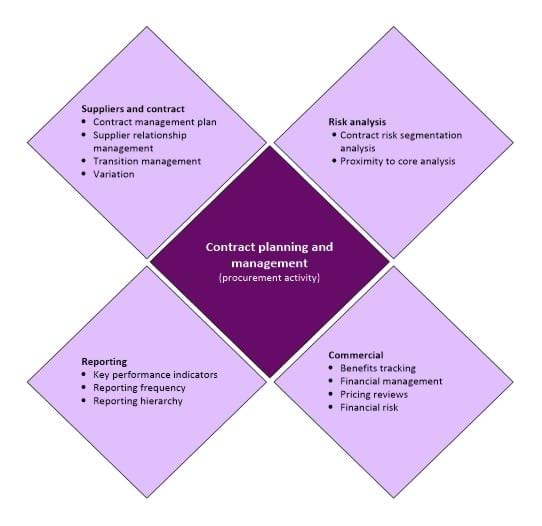

Four components of contract planning and management

There are four key components in contract management:

- risk analysis

- commercial

- suppliers and contract and

- reporting

These four components are shown in the following figure and provide a context for contract planning and management at the individual procurement activity level.

Figure: Contract planning and management framework

The figure shows the four components of contract planning and management (procurement activity):

- Risk analysis

- contract risk segmentation analysis

- proximity to core analysis

- Commercial

- benefits tracking

- financial management

- pricing reviews

- financial risk

- Suppliers and contract

- contract management plan

- supplier relationship management

- transaction management

- variation

- Reporting

- key performance indicators

- reporting frequency

- reporting hierarchy

This guide further explores these four components to assist procurement practitioners perform effective contract planning and management.

The following table provides a list of tools and templates available to assist contract planning and management:

Contract components and relevant tools

| Contents | Contract planning | Contract management |

|---|---|---|

Risk analysis Defining the level of risk – contract risk segmentation tool Defining criticality to business | Highly relevant Highly relevant | General consideration to be given to risks and criticality. |

Finance Benefits tracking (qualitative and quantitative) Pricing reviews Financial risk Insurance checklist | Highly relevant Highly relevant Highly relevant Highly relevant | Relevant where applicable Relevant where applicable Highly relevant |

Suppliers and contract Contract management plan (short or long) RACI (responsible, accountable, consulted, informed) Record management Governance checklist Transition in and out | Highly relevant Highly relevant Highly relevant Highly relevant Highly relevant | Relevant where applicable Relevant where applicable Relevant where applicable Relevant where applicable |

Reporting Performance management - KPI and supplier performance scorecard Data collection Reporting Customer satisfaction survey | Highly relevant Highly relevant Highly relevant Highly relevant | Relevant where applicable Highly relevant Relevant where applicable |

Risk analysis

Each procurement activity carries its own level of complexity and risk. As noted previously, each individual procurement can be positioned in one of four contract planning and management segments:

- transactional

- critical to the business

- high risk

- strategic

Different contract management process, tools and templates apply depending on the segment in which the procurement activity resides.

Tools: The interactive Contract risk segmentation tool and the Defining criticality to business assessment tool help contract managers allocate procurement activity to a segment based on the level of risk. It can also be used to monitor risks over the life of a long-term contract (three+ years), particularly contracts of a strategic nature.

Value can be added to the contract planning and management phase by considering the areas of focus listed in the following table

Areas of focus under each risk quadrant

| Risk level | Focus | Supply profile | Considerations |

|---|---|---|---|

| Operational | Transactional excellence | Provide goods and services deemed both low risk and low operational significance. However, spend volume can be such that a degree of operational governance is required. | Apply good management practice. Use basic standard form contracts. |

| Critical to business | Performance and value | Provide goods and services integral to operations. However, risk of failure is unlikely and no major disruptions would occur. | Develop and apply a short-form contract management plan (CMP) to add rigour to process oversight and monitoring of supplier performance. |

| High risk | Risk management | Provide goods and services with high risk of failure yet would have low operational significance to the organisation if the arrangement fails. | Assess whether there are opportunities to migrate all or elements of the supply arrangements to a lower risk segment. Develop a long form CMP and subject supplier to regular performance monitoring to drive supplier performance. |

| Strategic | Strategic alignment | Integral to operation of the business, failure of the arrangement would result in major disruption to operations. Highest level of strategic alignment, risk mitigation, governance and performance monitoring is to be applied. | Review risk treatment strategies with the intent of migrating risks to a lower level. Where possible investigate secondary supply sources, overlay a high-level rigorous supplier performance framework and clearly define issues escalation process. Develop a long form CMP and subject supplier to regular performance monitoring to drive supplier performance. |

Commercial

Financial management

Financial management/monitoring should be considered in both contract planning and management.

Contract planning

- rates, e.g. services/products are consistent with contract rates

- rebates/volume discounts being received

- early payment discounts

- opportunities to gain discounts if the volume is significantly above the agreed contract volume specification

Contract management

- submitting invoices in accordance with contract and/or supplier management plans, e.g. fortnightly, monthly, by deliverable

- processing invoices with respect to completion of work in full and to the required quality

- processing invoices in accordance with the organisation’s accounts payable and complying with the Government’s commitment to avoid submitting late payments to suppliers

- monitoring supplier costs on a regular basis

If applicable, the final payment of an expiring contract should ideally be retained until the supplier has completed contract obligations in full, e.g. any outstanding issues have been resolved.

Note: This should only be done in accordance with contract terms and conditions.

The Financial tracking checklist helps you manage and monitor financial components.

Pricing reviews

Most contracts include a price per unit of measure. Where contracts include a reference to price review, the contract manager should ensure that pricing reviews are conducted in accordance with terms and conditions and identified at contract execution.

The following is a list of some market forces, which could impact the contract price and value throughout its life:

- labour market index

- consumer price index

- utility pricing

- exchange rates used in the contract

- legislative/ regulatory requirements

Contract managers should seek financial advice to validate price review estimates.

Financial risk

You can also derive value from a contract when risks are mitigated and minimised into lower risk segments, i.e. ‘critical to business’ to ‘transactional’. Managing financial risks is an important value driver, particularly for supply arrangements in the ‘strategic’ and ‘high risk’ segments. It is recommended that a regular review be conducted to assess the supplier’s financial viability throughout the life of the contract financial risks and their mitigation.

Ensuring that suppliers maintain appropriate insurance is one way to manage risk exposure.

Contract managers should:

- capture and monitor information regarding supplier certificates of currency, including values and expiry dates and ensure that certificates are at or above the insured amounts

- monitor certificates to ensure their currency

- request updated certificates from the supplier at a minimum of 4 to 6 weeks prior to expiry of existing certificates

- where the contract is proposing capping of liabilities, include this in the contract segmentation analysis tool as it changes the level of risk associated with the contract

- ensure certificates of currency are stored appropriately

Some examples of certificates of currency include:

- product liability

- public liability

- professional indemnity

- workers compensation

- bank guarantees

The Contract insurance checklist records insurance provisions and currency.

Suppliers and contract

Contract management plan

The objective of a contract management plan (CMP) is to identify and address the key areas associated with managing the contract and achieving specified objectives. It summarises key components of the contract, translating the contract terms and conditions into a practical guide that defines the overall approach for contract management.

There are two versions of the CMP template.

- the CMP – short form provides a basic level of management for critical to business segments where the contract management risk is low

- the CMP – long form provides a detailed contract management plan for contracts identified as high risk and strategic in the contract management segments

A CMP can add value by outlining:

- contract objectives and outcomes

- roles, responsibilities and obligations of the parties and their agents

- how the contract performance management and reporting (KPIs) will be managed

- how benefits will be tracked and reported

- reporting and communication protocols and purpose

- the financial management approach, including supplier health check

- the framework for managing variations, changes to program, slippage

- contract governance requirements

- issue management and process

- negotiation strategies to improve on specification outcomes

These CMP templates can be modified and adapted to suit particular relationships with suppliers including:

- single supplier/single service/goods

- panel of suppliers providing the same goods/services

- single supplier with multiple contracts for goods and services in the same broad category e.g. software or computer hardware or freight

- single supplier with multiple contracts for goods and services in differing categories (e.g. computing agency labour, hardware, warehousing and logistics)

Supplier relationship management

Good relationship management establishes clear lines of communication and responsibilities between the organisation and the supplier.

Key aspects of relationship management include:

In contract planning:

- building strategic relationships between the key stakeholders in the organisation and suppliers to drive contract performance

- identifying and building on mutual benefits

- establishing operational relationships between the organisation and suppliers to coordinate day-to-day operational components of the contract

In contract management:

- management to management relationships to alert and mitigate issues that arise during the life of the contract and

- embedding open communication to ensure both parties can provide feedback to drive continuous improvement.

The Responsible, accountable, consulted, informed (RACI) template identifies roles and responsibilities related to the CMP – long form.

The Contract governance checklist covers the key steps in supplier and contract management.

Transition management

Where applicable, in contract planning, you should consider transition in and out processes with a clear program of actions and a communications strategy for both suppliers and users of the goods/services.

The Transition in and Transition out checklist highlights matters for consideration in the transition process.

Variations

A variation to contract is a mutually agreed amendment to vary the obligations set out in a contract for goods and services. There are many reasons to vary an existing contract. For example, changes in technology, resources, needs of the organisation, market conditions, etc. Variations can generally be categorised as either administrative or financial:

- administrative variations are changes that do not affect the financial details of the contract, e.g. changes to the billing process, delivery address, personnel assigned to the contract, sequencing of work, performance management and monitoring processes, etc.

- Financial variations alter the financial details of the contract, e.g. changes to the price/cost, quantity, nature of the deliverables and terms of the contract (which increase the value)

When addressing variations to contract, ensure that you:

- manage variations or changes to the contract in accordance with the terms and conditions of the contract

- justify the variation based on documented evidence essential to the delivery of the goods/services

- do not change the original intent or general scope of the contract

- consider whether the additional requirements would be better managed under a new contractual arrangement

- satisfy the core procurement principles; value for money, probity, scalability and accountability

- put appropriate contract management procedures in place to minimise the need for further variations

- confirm that sufficient funds are available

- have the variation endorsed and signed by both parties to ensure there is a common understanding of the required changes

- approve and report any changes to contract terms and conditions through the formal channels

When there are multiple variations to a contract, consideration should be given to:

- whether the contract planning strategy framework needs improvement to minimise the need for further variations

- escalating the issue of project management oversight and appropriate capability through the governance reporting arrangements established by your organisation

- whether to approach the market again should there be a significant shift in the scope of the procurement

Approving variations

A variation to contract needs appropriate approval. Administrative variations are generally approved by the contract manager whereas financial variations require approval by a financial delegate.

For variations to state purchase contracts or a sole entity purchase contracts, refer to the Guide to aggregated purchasing demand.

Reporting variations

Where an individual variation takes the contract value over $100,000 or any variations to contracts over $100 000, it should be disclosed on the contract publishing system.

Pre-approved variables

Some contractual arrangements have agreed pricing formulas for goods/services that allows for price fluctuation. If the pricing formula was approved through the procurement process, variations are limited to the scale agreed in the contract. The contract is to be appropriately monitored to ensure value for money is maintained throughout the life of the contract.

Assess value for money

Assess achievement of value for money (actual value delivered and actual cost) and the potential to achieve more.

Assessing achievement of value for money should be conducted as part of contract reviews. The contract should be reviewed at least annually, prior to exercising an option to extend, on contract closure, and as required.

Assess achievement of value for money by measuring value/benefits and costs, including:

- Agency performance of contractual obligations

- demand/usage

- user and stakeholder satisfaction

- broader government objectives

- key performance indicators (KPIs)

- actual cost of ownership/spend (contract and other), including savings/efficiencies

- abatements or liquidated damages

- receipt of discounts for volume thresholds, early payment, etc

- risks realised/emerging and costs to treat

- benefits from innovations/learning economies

- impacts on the market such as improved productivity, competition, skills, capacity

Assess the potential to achieve more value for money when considering:

- exercising an option to extend versus contract expiry and ceasing the procurement versus returning to the market for a replacement contract (with enough lead time to test the market or to give notification of exercising the option)

- a material contract variation (not administrative amendments that do not impact value for money)

Benchmark the outcome of the assessment against previous or similar contracts to ensure the contract remains competitive and aligned with evolving market conditions.

Ask “is this right for the Agency?” during a contract review, option to extend, or contract variation. If value for money is not being achieved as expected, then act:

- collaborate with the supplier to better manage performance

- vary the contract

- don’t exercise an option to extend

- if warranted, terminate the contract

Reporting

Performance management

Performance management is a critical element in all contracts to assess whether a supplier is meeting their obligations under contract.

Developing performance measures is an integral part of the contract planning phase and should be included in the contract terms and conditions. The level of performance management is scalable however, maintaining consistency in recording information is important.

For strategic and high risk contracts, the contract can be divided into two categories: service level agreement (SLA) and key performance indicators (KPI).

The SLA is a formal negotiated agreement between two parties that sits underneath the contract of appointment. It sets out minimum performance levels required under the contract.

KPIs are metrics used to quantify the performance of the supplier and monitor adherence to the SLA on a predetermined frequency. When set correctly, KPIs give an early indication of when the supplier is struggling to reach the agreed level of service.

The KPI and supplier performance scorecard helps build KPIs and can also be used to develop specification/quote/tender documents and to enhance the CMP.

Supplier behaviour is influenced by the performance measures adopted. Keep KPIs to a minimum—a few targeted, measurable KPIs are better than many unmeasurable KPIs. Performance measures should strike a balance between supporting performance management activities without incurring unnecessary costs.

Key considerations in relation to performance measures include:

- is the intended measure clearly understood by both parties

- do the measures focus on contract performance against contract deliverables and intended value

- can the measure be objectively assessed

- do the measures encourage performance improvement over the life of the contract

- is the performance regime cost effective to administer for the organisation and the supplier

- does contract performance against the measures provide the basis for identifying underperformance and provide grounds for remedial action and/or penalty payments.

Reporting process

Where relevant, the contract should include provisions for ongoing monitoring and assessment. For example, how often to report contract performance (monthly, quarterly, annually or aligned with a contractual milestone) and how to carry out performance assessment.

An organisation may assess performance using their own qualitative and quantitative data sources such as an organisational level customer satisfaction survey.

The Supplier customer satisfaction survey can be used to survey stakeholders and customers to gain feedback on supplier performance.

The supplier may carry out a self-assessment and report to the organisation. While this does not provide an objective view, it may still offer a method for monitoring performance where the contractor has customer feedback and data embedded in their own systems.

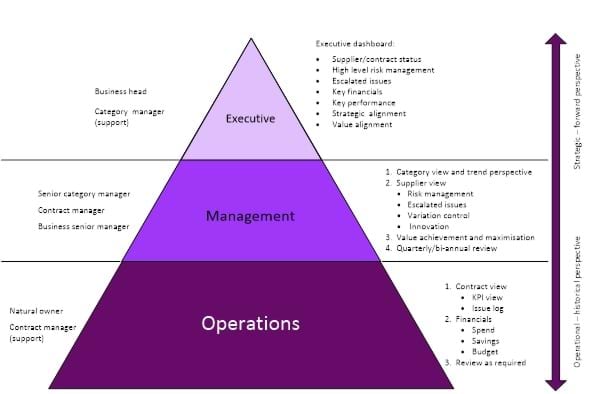

Scalability in reporting

The following figure provides an example of the contract management reporting structure and shows the scalability that can be applied depending on the requirements and complexity of the contract and organisational requirements.

The figure shows the scalability framework for reporting.

The figure shows the scalability framework for reporting.

- Executive:

- comprises:

- business head

- category manager (support)

- executive dashboard:

- supplier / contract status

- high level risk management

- escalated issues

- key financials

- key performance

- strategic Alignment

- value alignment

- comprises:

- Management:

- comprise:

- senior category manager

- contract manager

- business senior manager

- reporting:

- category view and trend perspective

- supplier view – risk management, escalated issues, variation control, Innovation

- value achievement and maximisation

- quarterly / bi-annual review

- comprise:

- Operation:

- comprise:

- natural owner

- contract manager (support)

- reporting:

- contract view – KPI view, issue log

- financials – spend, savings, budget

- review as required

- comprise:

Operational reports have a historical perspective.

Strategic reports have a forward perspective.

Issues management

Logging, managing and reporting issues is a vital function when managing a contract. An issue, if not addressed immediately, can have serious repercussions.

The Supplier scorecard issues log is an important tool in identifying and responding to issues.

Operational reporting

Operational reporting is the foundation for contract management reporting of procurement activities. It includes detailed performance against agreed KPIs and SLAs and other information identified as relevant by the contract manager and operations personnel.

Management reporting

Management level reporting provides information to support decision-making at the management level and includes key supplier and contract information for strategic, high risk to the organisation and critical to business contracts, including contract status, financials, performance data, escalated issues and risks.

Executive reporting

Executive level reporting provides information to support decision-making at the most senior level where key project performance is integral with organisational program delivery, program budget allocation, organisational governance, capability reviews, effective risk, and financial management.

Using this guide

This guide accompanies the goods and services supply policies. There are 5 supply policies:

- Governance policy

- Complexity and capability assessment policy

- Market analysis and review policy

- Market approach policy

- Contract management and disclosure policy

This guide supports the Contract management and contract disclosure policy.

The following contract management tools and templates are available in the Goods and services toolkit to support this guide. They should only be used if relevant and should be modified to suit your organisation’s needs:

- Contract risk segmentation tool

- Defining criticality to business assessment tool

- Contract management plan – short form

- Contract management plan – long form

- Financial tracking checklist

- Contract insurance checklist

- Contract governance checklist

- Transition in checklist

- Transition out checklist

- RACI (Responsible, Accountable, Consulted and Informed) template

- KPI and supplier performance scorecard

- Supplier customer satisfaction survey

- Supplier scorecard issues log

Tools and support

Access a document version of this guide in the Toolkit and library.

For more information about contract management, please contact the goods and services policy team.

Updated